“Trading Journal Entry #2”

Stocks today are slightly higher, with traders seemingly at a standstill ahead of Wednesday’s inflation data. Some positive news around GOOGL’s breakthrough in quantum computing sent it up 4%, while ORCL tanked more than 9% after disappointing Q2 adjusted revenue fell below consensus.

The market seems to have stalled out in anticipation of upcoming economic releases and the FED meeting. Has the Trump Trade come to an end? Will we see a Santa Rally? These are the questions on every trader’s mind at the moment.

In my opinion, I find these downtimes to be great opportunities for the extra work that often gets pushed aside when everything is trending up. The intoxication of non-stop gains can be a distraction from the building blocks every trader needs to take time to work on.

I like to run a series of screeners and look for outliers—companies bucking the trend or showing strong footing when the broader market is not. I then spend time learning about these companies, especially those I don’t know much about.

As traders, I think many of us enjoy this process. It’s like digging for gold: sifting through the dirt and adding potential winners to our “gold box” for later. In our case, that means finding multi-baggers, ten-baggers, or potential face-melting gainers.

On days like today, it’s easy to get bored and overtrade. I’ve learned to spend that time on research, analysis, and building watchlists and new screeners instead. Below are three charts from the 50+ I reviewed today:

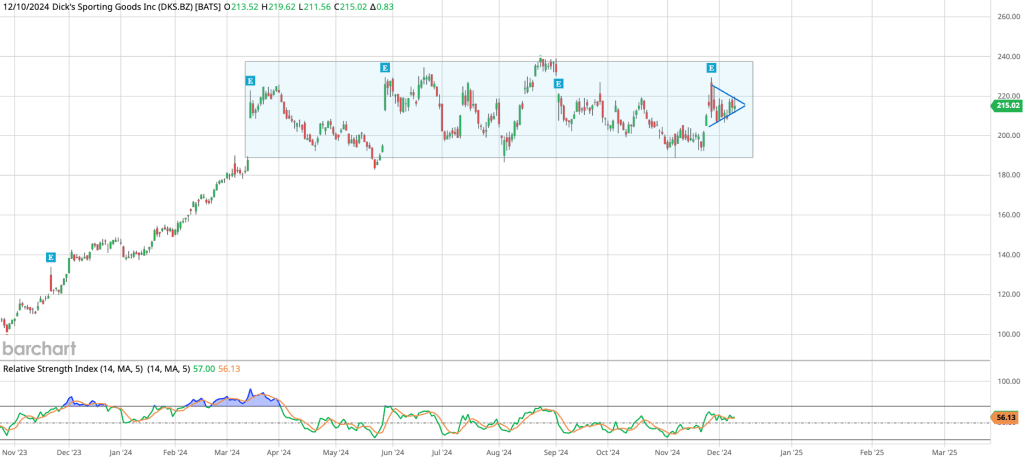

Dicks Sporting Goods (DKS)

DKS has been range-bound between $185 and $240 since March 2024. A small bullish pennant is forming on the daily chart, which might finally push this strong company to break out to the upside. With the holiday season in full swing, this could act as another positive catalyst.

Clear Secure (YOU)

Clear Secure is a more obscure stock, but you might recognize it. You’ve seen those kiosks at the airport security lines with the word “Clear” on them. They claim all you need is a quick eye scan to breeze through security if you’ve pre-enrolled.

Recently, the company has made enrollment easier with sign-up areas outside airports, and they’ve also partnered with Uber. After a major selloff due to a small EPS miss last quarter, I think the market overreacted. With a positive outlook for 2025, Clear Secure recently crossed back above its 20-DMA.

AST Spacemobile (ASTS)

The modern space race continues, and it’s thrilling to watch. Growing up, I loved everything space-related, and now it feels like those childhood dreams are becoming reality. Companies like RKLB, LUNR, and ASTS have been the standout “darlings” of this emerging industry over the last 12 months.

SpaceX, Elon Musk’s brainchild, was recently valued at over $250B. It makes me wonder what these smaller companies with $1B-$11B market caps could grow into if they captured even a fraction of SpaceX’s value.

Currently, ASTS is retesting the upper line of a falling wedge pattern it recently broke out of. The next major resistance is between $29 and $31.50. It’s tested this range three times, and the fourth attempt could be the deciding move.

Breaking Bad Habits & Over-Trading

As I continue to write about my learning lessons in the stock market, one of my most difficult battles is trading out of boredom. Especially when markets have nothing to offer. This week is a great example of facing boredom head-on and not over-trading.

The ego—my ego, more specifically—needs to feel like I accomplished a task. What better task then pressing buttons and losing money. Fast, real fast.

Training myself to feel this sense of accomplishment, from actually not doing anything at all is, quote-unquote, strangely unrewarding.

Yet, tracking trades, proves: the less I trade, the more money I make—and keep. How green my month is often comes down to how few trades I took.

At first, it was about learning I didn’t need to trade the entire day from market open to market close. Slowly, I realized that if I wanted any longevity in this business, I’d need to stop immediately.

I’d love to say I stopped as soon as I learned that I was losing money trading blindly. I’ve been trading off and on since 2015 and it took many years to finally gain some control. I couldn’t stop compulsively hitting the buy or sell button. I was like a drug addict needing just one more hit.

Maybe it’s because I’m a recovering drug addict, and habits—especially negative ones—sit with me like two peas in a pod. I snuggle in close, make them my friends, and hold on tight to make sure they never leave. That is, until they almost kill me, leave me broke and begging for mercy.

Trading has been like that for me. A roller coaster of ups and downs. I’ve found Jesus, I’ve found the devil, tick by tick. I’ve grown, and mustard the strength to change. Fortunately, I let go of my preconceived notions and started following a strategy.

Final Thoughts

Trading takes time. There’s no perfection, and chasing it will drive you insane. I’ve stopped trying to control the markets—something we just can’t do. It’s like yelling at the ocean to stop crashing waves.

But we can strive for perfection in how we react and the choices we make. It’s no one’s responsibility but ours to take ownership of our decisions and live with the outcomes. That’s the hardest part—full ownership. But that’s also freedom, my friends.

Live to trade another day.

– Mark

Leave a comment