A list of Small Cap Stocks Making & Breaking Dreams and what to Expect…

“Subscribe for Stock Picks, Trends & Trading Lessons sent directly to your inbox.”

As the trading year nears its close, U.S. benchmark equity markets continue to grapple with uncertainty. Major indexes wrapped up the week on a somber note, with the S&P 500 sliding 1.3% to 5,959.2, the Nasdaq Composite shedding 1.7%, and the Dow Jones Industrial Average losing 0.9%. Consumer discretionary and technology stocks led the decline, with household names like Nvidia, Microsoft, Apple, and Amazon taking hits. Tesla, in particular, faced the sharpest drop, down 5.5%, leaving investors with a sour taste heading into the new year.

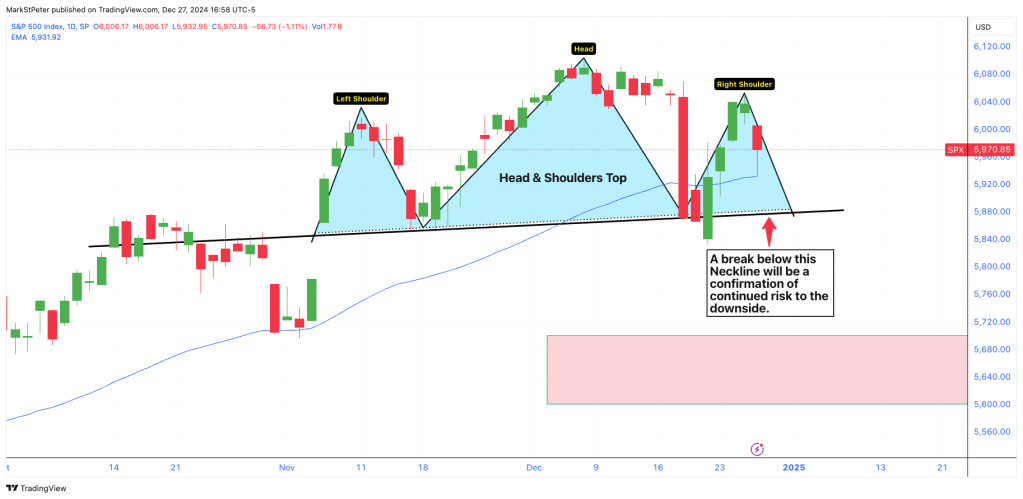

Amidst this backdrop, the SPX is showing a textbook bearish pattern—a head and shoulders top. This formation has historically been a red flag for equity markets, often signaling further downside. Let’s break down what this could mean for traders, followed by a closer look at individual stocks on my Sunday Scan Watchlist.

Table of Contents

- SPX Analysis: The Head and Shoulders Warning

- Sunday Scan Watchlist: Stocks to Watch This Week

- Conclusion

SPX Head & Shoulders Top

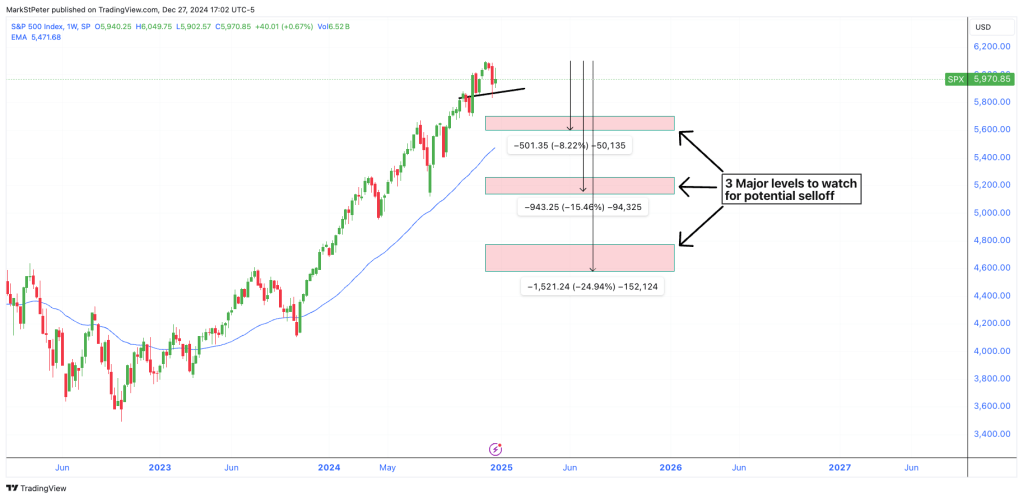

The SPX is presenting a textbook head and shoulders top—a pattern that has historically signaled heightened downside risk for equity markets. With the price nearing the critical neckline, all eyes are on whether it holds or breaks. A decisive move below this level could pave the way for a drop to the next significant support zone around 5,600.

This is a pivotal area for traders and investors to keep on their radar. If market conditions continue to deteriorate, we could see an accelerated decline, making caution the key theme for the coming weeks. Staying proactive and vigilant in this environment will be essential for navigating the potential volatility ahead.

Sunday Scan Watchlist

While the SPX keeps us on edge, individual stocks are presenting opportunities on both the upside and downside. This year has been defined by market cycles, with standout moves in sectors like Aerospace, Semiconductors, and even Cruise Lines. RUM soared on the Trump trade hype, SOUN rode the AI wave, and RGTI capitalized on the quantum computing buzz. Here’s what I’m watching for in these three stocks this week:

Rumble Inc (RUM) – Neutral/Short

RUM has had a remarkable run this year, with its price climbing 252% at its peak, largely fueled by renewed optimism after President Trump’s election. The stock has pulled back from its recent high of $17.44 to $15.23, and I believe it has room to test its all-time high of $18.50 again before facing a strong rejection.

With the Put/Call Ratio increasing to 0.61, there are hints of caution among traders as the price continues to rise—a typical pattern for a rally nearing exhaustion. My plan? Watch closely for a move toward $18.50 and, if we see rejection, I will consider buying PUTs or shorting the stock.

SoundHound AI Inc (SOUN) – Long

SOUN has been an unstoppable force lately, climbing at an accelerating pace with little resistance. However, as much as I admire the momentum, I can’t ignore the spinning top candlestick on the daily timeframe—a sign of indecision. Paired with a rising Put/Call Ratio of 0.80, there are early signs of caution entering the picture.

Despite these potential warning signs, I remain bullish for the week ahead. The stock may rebound from Friday’s sluggish performance and resume its climb into the new year. I’ll be looking for confirmation of continued upward momentum early in the week.

Rigetti Computing Inc (RGTI) – Short

RGTI ended last week with a spinning top candlestick, signaling indecision after a meteoric rise. As my grandpa used to say, “Don’t back the wrong horse.” I think this hype train may be running out of steam, especially with after-market activity showing a decline of over 3.5%.

RGTI is part of the quantum computing hype cycle, which, like other sectors this year—Aerospace Defense, AI, Crypto, Cruises, and Semiconductors—has its moments but often faces corrections. It’s time to reevaluate whether there’s room left for growth or if the risk is skewed to the downside. My outlook leans bearish for the near term.

Conclusion

The SPX is showing strong signs of a top or atleast a short-term top, and caution should be taken. Though like most of the year, the biggest moves have run on hype cycles. The end year, is usually when cycles come to an end, as traders and investor rebalance portfolios.

With that said we have one more week of trading and only four total days we can trade. So any cycles, still happening are more than likely to finish very soon.

The trades I listed on the watchlist highlights opportunities for both the bulls and bears, with RUM and RGTI offering short setups, while SOUN continues to climb but warrants caution. All of the above trades are based on a short term trading timeframe, as I will cautiously watch as we enter the new year and change of president.

“Subscribe for Stock Picks, Trends & Trading Lessons sent directly to your inbox.”

Leave a comment