First Trading of the Year and Market Reaction to AAPL, AMD, MGC, & HGH.

“Subscribe for Stock Picks, Trends & Trading Lessons sent directly to your inbox.”

It’s official the start of 2025 has begun with the first trading day of the year said and done. After four straight losing days to end the year, the initial market open came out swinging, with most of the major indices moving up. As we settle into the first trading week, the market seems indecisive, with increased volatility.

Here’s a breakdown of my trading day, the setups I tried and failed, and some lessons learned.

Table of Contents

- Market Observations

- Major Indices: SPX, DOW, RTY, & NASDAQ

- My Trade of the Day: /HGH (Copper)

- Lessons from Today’s Trading Session

- Gold Watch

- Final Thoughts

Market Observations

AMD… Same Ol’ Behavior

Amd continues its long-term bearish channel from it’s all-time high of $226.90. Today, it dipped to $120.86 before bouncing back to the $122.7 range, before settling lower on the day. I’m keeping my eye on the $95-$105 range as the next major support level for a potential reversal.

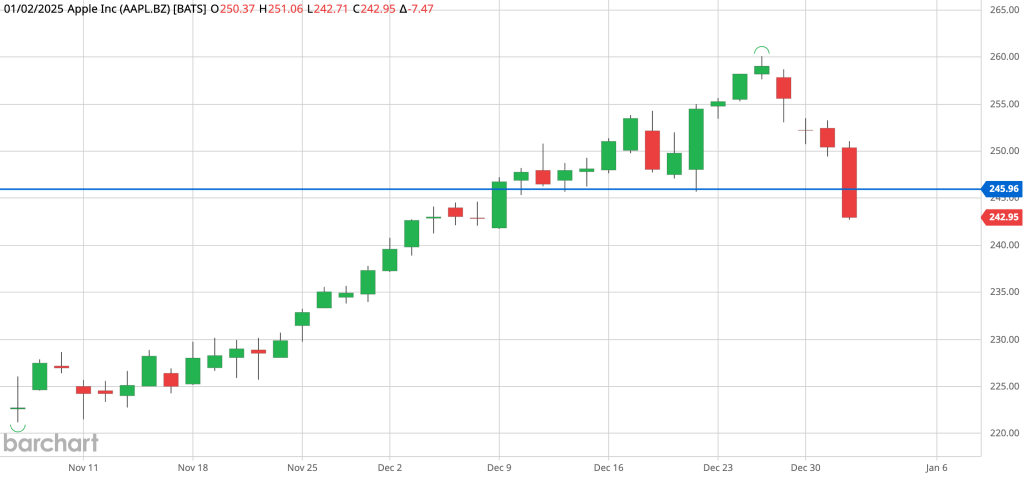

AAPL… Is it a Buy at $242?

AAPL had a rough start to the morning, plunging to $244, with no breaks, it just kept falling, until the price of $242.40, at the time of writing. After AAPL broke through a major line of support at $246, it’s next major line of support is sitting at $241. Until we get a conformational bounce from this price, it’s better to sit and wait before acting to quick to jump in. If price can’t hold above the $241, you don’t want to get caught holding the bag.

Major Indices

- SPY/ES (SPX): Dropped pre-market but rebounded shortly after the open. Volatility is high.

- QQQ/NQ (NASDAQ): Mirrored SPY with a pre-market dip and an early bounce.

- IWM/RTY (Russell 2000): A sharp drop followed by a rebound.

- DOW/MYM: Started strong but gave up gains quickly, dropping to $42,875. Support seems elusive.

Overall, the market remains volatile as institutional investors rebalance portfolios. This seems to be in a shift towards fixed-income assets.

My Trade of the Day: /HGH (Copper)

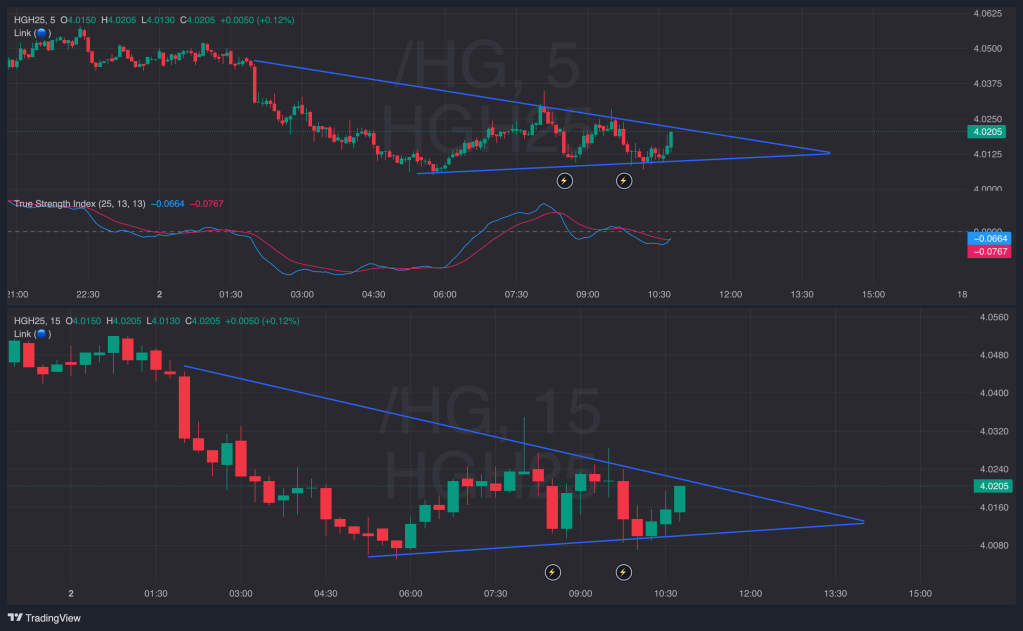

Copper presented an intriguing setup with a bearish pennant forming on the intraday charts and a TTM Squeeze indicator signaling a larger move. Despite recognizing the bearish setup, I took a long position after a brief breakout attempt.

What happened?

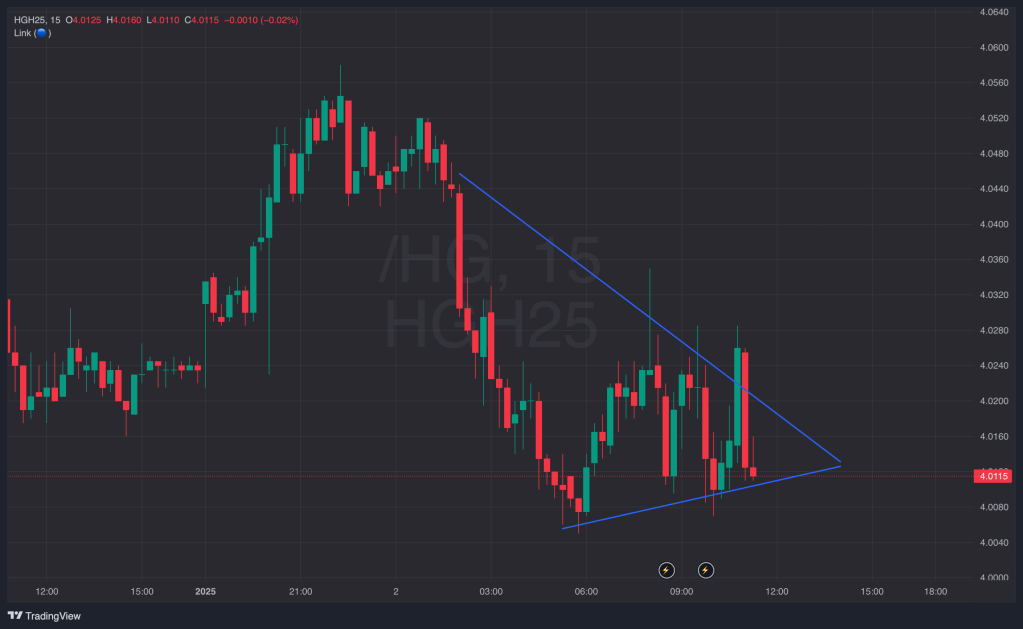

Result: A $368 loss.

After entering, Copper quickly reversed and retested its support. I held on, hoping for a relief bounce, but ultimately cut my losses when the move failed to materialize.

Quickly after cutting my losses, the price of HGH quickly went back up as luck would have it.

What I did about it?

I felt it was better to stop my trading day where it was, and not suffer any more losses on the day. I can feel when I am not in tune with the markets, whether it be the lack of sleep a 3 week old newborn brings to your life – it doesn’t matter. It only matters that I take control of the situation in the best way I can, and that was to lock myself out of my trading screen for the day.

Here’s what I saw on the charts right before I entered. The second chart is what happened right after I entered 🙃

I took a long position on /HGH after setting a limit order at the previous resistance line of $4.02. Price quickly kept falling until taking out my stop loss order.

Lessons from Today’s Trading Session

- Patience is Key:

I identified the bearish pennant yet acted against my analysis. Waiting for confirmation would have saved me from this losing trade. - Multi-Timeframe Confirmation:

Don’t act hastily. Confirm on multiple timeframes. - Avoid FOMO:

My fear of missing out led me to jump into a trade without solid confirmation. Next time, I’ll prioritize my strategy over impulsivity. - Stop Loss Flexibility:

Today’s whipsaw price action repeatedly triggered stop losses. Allowing a bit more room for fluctuations might have kept me in trades that eventually worked. - Trade the Market, Not the P&L:

Focusing too much on P&L leads to emotional decisions. I need to stay disciplined and let the market dictate my actions.

What I did that I am proud of?

Setting a lock out period on my trading screen is hard decision, as you will always feel you can make losses back or there is more to be gained. The click of a button can be quick, and before you know it, you can’t trade for the rest of day. The mental aspect leading up to that decision seems like an internal struggle. But the sense of control it enacts, lets me walk away from the trading day at least with my dignity.

Gold Watch

Amid the noise, GOLD caught my attention. It’s trading within a large symmetrical triangle on the daily chart and has broken above its 10- and 20-day moving averages. The $2,721.50 range looks like the next logical target. I’ll be watching this one closely tomorrow.

Final Thoughts

Today wasn’t my best, but it was a valuable learning experience. Trading isn’t about being perfect—it’s about adapting and improving. Tomorrow’s another day, and I’m ready to approach it with patience, discipline, and a clear plan.

What were your biggest takeaways from today’s market action? Share your thoughts in the comments below!

“Subscribe for Stock Picks, Trends & Trading Lessons sent directly to your inbox.”

Leave a comment