Trading Outcome for the first full week of the Trading Year of 2025.

“Subscribe for Stock Picks, Trends & Trading Lessons sent directly to your inbox.”

The market opened with the energy of a shaken bottle. After building momentum in the pre-market, it brought the same enthusiasm into the market open, taking prices back to familiar areas. After the lackluster finish to 2024 and start to 2025.; it seemed retail and institutional traders were aligned in their behavior today. Which was to bid the markets higher.

Let’s take a look at some charts and the open market bahavior, as well as an update to my trading journal.

Table of Contents

- Pre-Market Setup: A Bullish Start

- Major Indices

- Momentum Drivers for 2025

- Bitcoin & Crypto

- Lessons for Today

- Final Thoughts

Pre-Market Setup: Bullish Start

The pre-market set the tone for the market open, pushing a lot of the bigger names into positive territory. Semi-conductor giants like NVDA, AMD, and SMCI all led the way.

Nvidia (NVDA)

NVDA powered through key resistance levels with impulsive strength, breaking through the $149 price range. The next major level to watch, it’s it’s recent All-Time High Price of $152. A break of this level would bring us into price discovery.

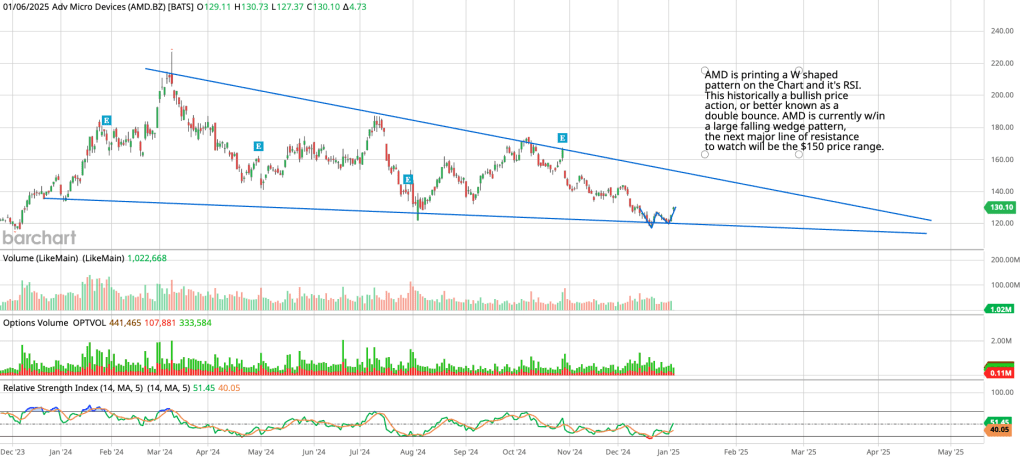

Advanced Micro Devices (AMD)

AMD has been in a long-term downward trend, bouncing within a falling wedge pattern. These are usually signs of consolidation with downward pressure. Yet, AMD has printed what looks to be a W shaped pattern or better known as a double bounce. Both on it’s chart and it’s RSI indicator. The next major line of resistance to watch is the $150 price range.

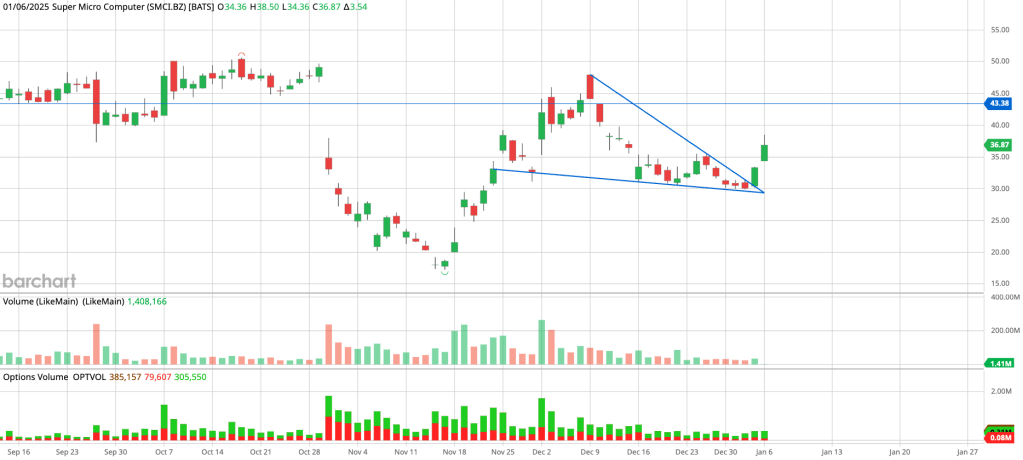

SuperMicro Computers Inc. (SMCI)

SMCI was hit hard after they had accounting issues early 2024. It has yet recovered from it’s drastic sell off but analysts are flipping the tone and turning bullish on the upcoming year. Consesous is getting prepared for its upcoming earnings release on February 2, 2025, with an estimated EPS of $0.54, which is a 5% uptick from the last quarters report of $0.51.

I like to look for strong companies, that have had major selloffs, and have been held down for any extended period of time. Especially when they have positive catalyst building up in the background. Mix that with a strong industry and niche, and you may have found a winner. Both SMCI and AMD fall into this category of being held down for extended periods of time, which continuing to post positive earnings reports, and positive news is circulating. It’s generally only a matter of time before the masses, gets back on board and send these strong companies higher.

Technically speaking, I’ll be watching for SMCI’s price to break above the $42 – $44 range.

Major Indices: SPX, NQ & RTY

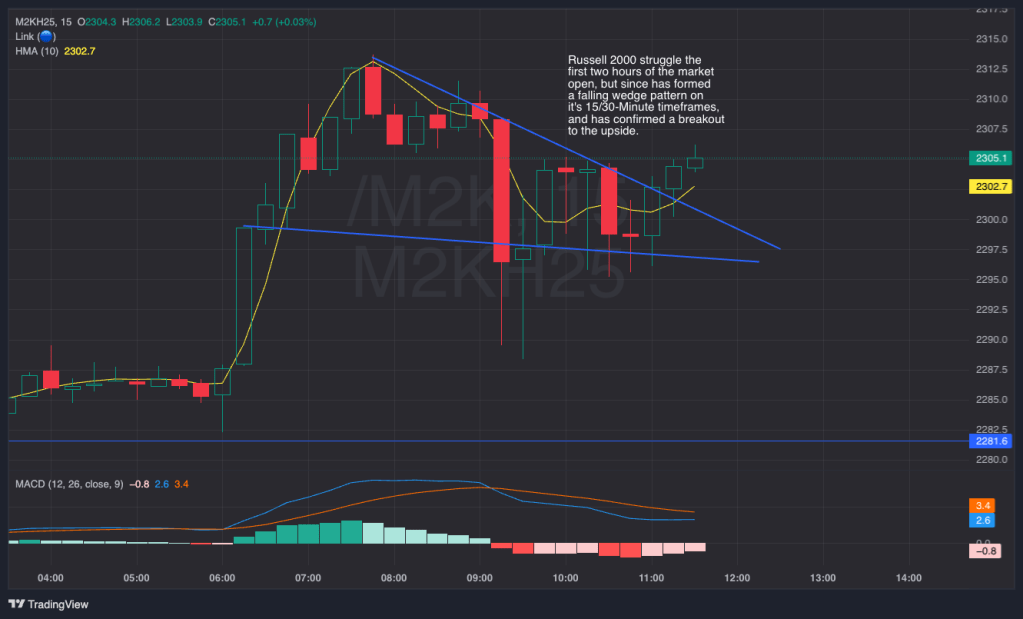

The SPX & Nasdaq came jumping out of the gates, after having a very strong pre-market rally. The Russell seemed to struggle the first two hours after the opening bell, but found some footing as we entered into the later half of the morning trading session.

The Nasdaq 100 (NQ) made a textbook breakout from a falling wedge pattern, confirming strength above the $21,630 resistance level. The pre-market rally was a clear signal for higher intraday prices, and the index delivered.

oth the NASDAQ100 (NQ) and S&P500 (ES) now sit at critical Fibonacci retracement levels—0.618 or 61.8%. If these levels break, we could see further gains:

- NASDAQ100: Targeting $22,100.

- S&P500: Heading toward $6,100.

As usual, the Russell 2000 moved in it’s own direction. While it struggled during the morning session, a short-term falling wedge pattern on the 15 and 30-minute time frames formed around 11:15 AM EST. Price later confirmed a breakout on the intraday time frame.

What’s Next for 2025?

This first full trading week of the year is pivotal. Two key factors will shape the market:

- Earnings Reports: Corporate earnings will be under intense scrutiny. Investors want to see consistent beats, especially from the tech giants. Weak earnings, even from a few key players, could weigh heavily on broader market sentiment.

- Big Tech Performance: NVIDIA (NVDA) must continue outperforming expectations to sustain bullish momentum. If it falters, the ripple effect could drag the market lower.

Bitcoin and Crypto Stocks Shine

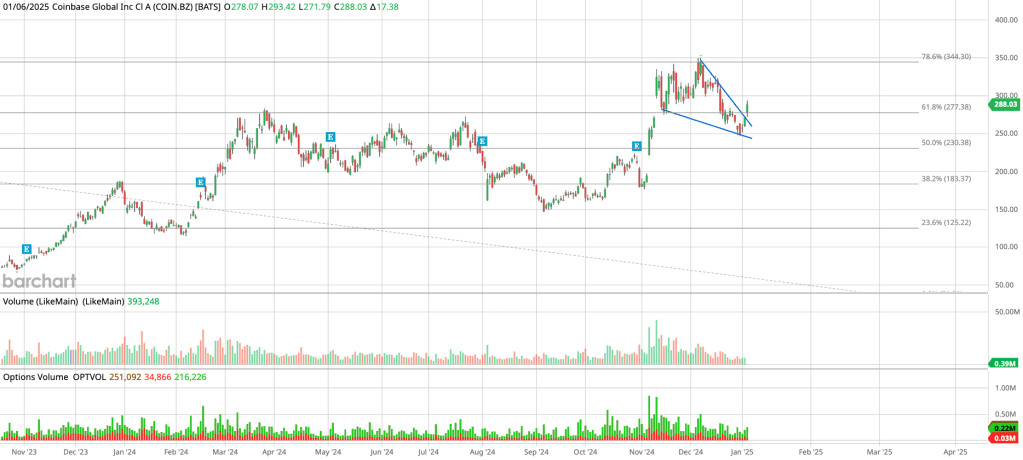

Even Bitcoin (BTC) joined the bullish party, breaking back above $100K and settling at $103K as of writing. This resurgence also boosted BTC-related stocks:

- Coinbase (COIN): Surged to $293 before cooling to $288. COIN continues to respect Fibonacci retracement levels. A move above $340 could be on the horizon if momentum holds.

Lessons from Today’s Trading Session

Every trading day teaches something new—or reinforces lessons already learned. Here’s what stood out today:

- Take Profits When They Align with Your Plan: If your profit target is hit, especially during a day trade, don’t hesitate. Greed can quickly erode gains.

- Step Away Post-Profit: After securing profits, I locked my trading dashboard for an hour. It’s Wall Street’s lunch break, and my strategy benefits from stepping back during this period of low volatility.

- Discipline is Key: Today was a testament to how sticking to my trading plan delivers results. When you work the plan, the plan works for you.

Final Thoughts: Stay Focused and Flexible

Today’s session was a great reminder of how fast markets can shift. Whether it’s semiconductor stocks like NVIDIA, indices like the Nasdaq 100, or even Bitcoin, opportunities are everywhere for traders who stay prepared and disciplined.

As we move further into 2025, keep a close eye on earnings reports and key technical levels. Success in trading is about adapting to the market while staying true to your plan.

What’s your take on today’s market action? Let me know in the comments, or join me in my trading journey by subscribing to the Trade Profit Journal newsletter!

“Subscribe for Stock Picks, Trends & Trading Lessons sent directly to your inbox.”

Leave a comment