Santas Fixing an Economy: Three Stock(ing) Stuffers (NVDA, BA, JBLU)

“Subscribe for Stock Picks, Trends & Trading Lessons sent directly to your inbox.”

Table of Contents

- Nvidia (NVDA) Confirmed Breakout

- JetBlue (JBLU) Inverted H&S… $10 Next?

- All I want for Christmas is a $200 Boeing (BA)

- Conclusion

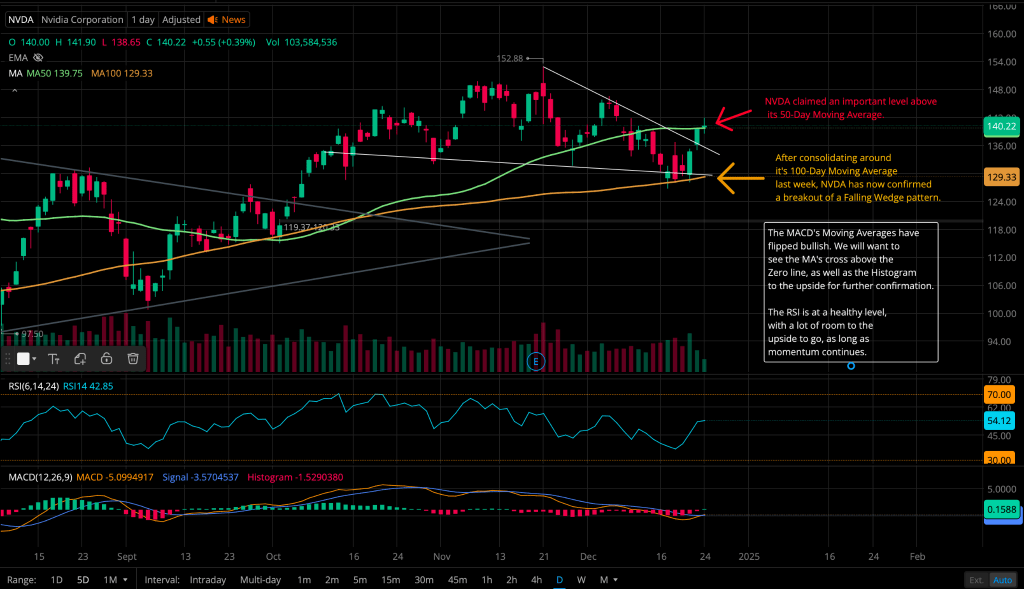

Nvidia (NVDA) Confirmed Breakout

Nvidia (NVDA) has broken out of a falling wedge pattern—a bullish reversal signal. After successfully holding its 100-day moving average at $129.33, NVDA surged above the 50-day moving average, closing at $140.22. These technical milestones indicate a renewed uptrend, backed by growing investor confidence. With the RSI maintaining a healthy level and the MACD flipping bullish, there’s plenty of room for the stock to gain momentum if broader market conditions align. Fundamentals remain solid as NVIDIA continues to dominate the semiconductor industry, bolstered by the AI revolution and data center expansion.

As we look toward the final trading sessions of 2024, NVIDIA’s breakout and improved indicators suggest it could be one of the year-end winners to watch. Will Santa bring a belated gift for NVDA bulls? Keep this stock on your radar as we continue to analyze other potential standouts in the market.

JetBlue (JBLU) Inverted H&S… $10 Next?

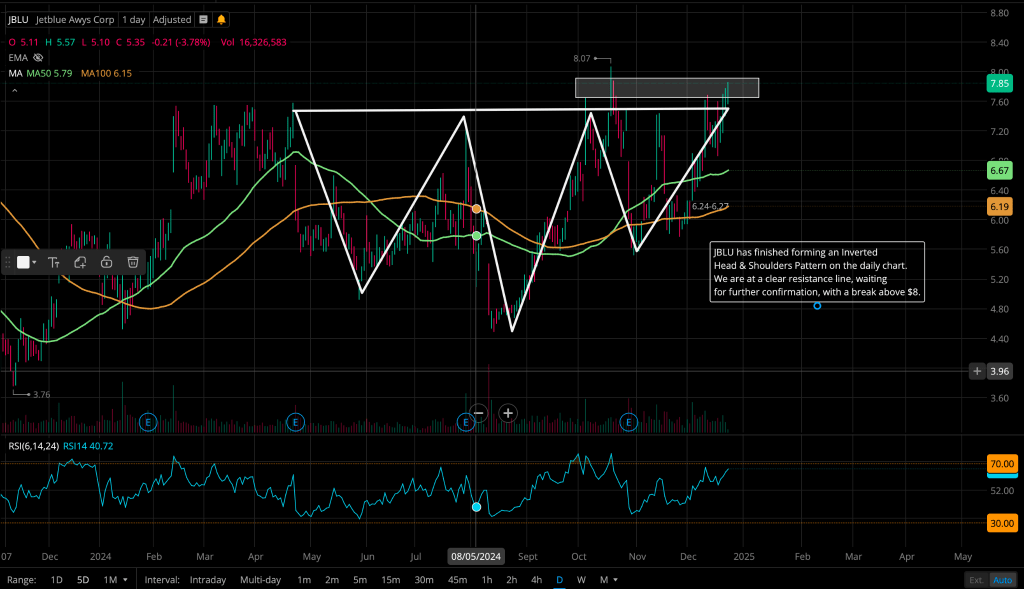

JetBlue (JBLU) is showing promising technical signals heading into the final trading days of the year. The daily chart reveals an inverted head-and-shoulders pattern, a strong bullish reversal indicator. JBLU is currently testing a key resistance level around $8, and a breakout above this line could confirm the pattern, signaling a potential move higher. The stock has also reclaimed its 50-day moving average, providing further support for a bullish outlook in the short term.

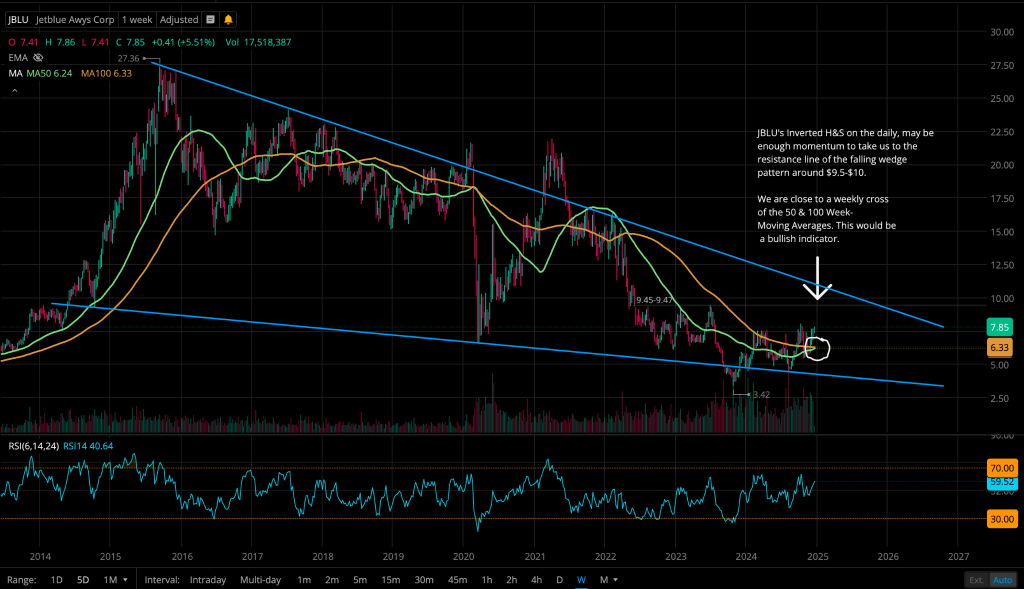

Zooming out to the weekly chart, JBLU sits within a long-term falling wedge pattern. A continuation of the current momentum could drive the stock toward the resistance line of this wedge, with a target range of $9.50 to $10. Additionally, the weekly moving averages (50-week and 100-week) are nearing a bullish crossover—a key technical signal that could attract more buyers if confirmed.

On the fundamental side, JetBlue may benefit from a seasonal surge in air travel during the Christmas and winter break periods. With increased passenger volumes expected, this could bolster investor sentiment and provide the momentum needed for the breakout. Keep an eye on these levels as JBLU looks ready to make a move in the coming days.

All I want for Christmas is a $200 Boeing (BA)

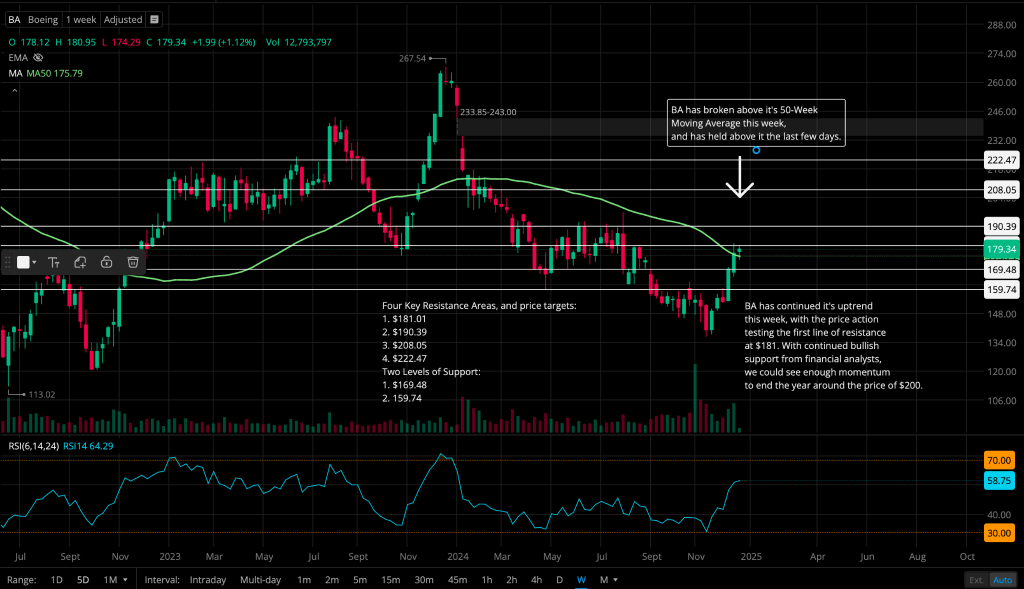

The Boeing Company (BA) has demonstrated robust momentum, climbing above its 50-week moving average and holding steady in recent sessions. This key technical breakthrough has positioned Boeing for further upside, with the stock testing its first major resistance at $181. Should this level be breached, the next target lies at $200, aligning with optimistic year-end projections fueled by renewed investor interest and bullish sentiment among Wall Street analysts.

Boeing’s resurgence is also bolstered by its strong presence in the aerospace and defense sectors, benefiting from sustained government contracts and the broader economic recovery. However, potential risks linger on the horizon. A competitive shakeup involving emerging players like TSLA, PLTR, and AI in the $850 billion defense contract market could weigh on Boeing’s future growth prospects. Investors will need to monitor these developments closely while gauging the stock’s ability to maintain its upward trajectory.

With clear technical levels and growing momentum, Boeing remains a compelling stock to watch as the year winds down. Continued strength above its resistance levels could confirm a bullish outlook for the weeks ahead, but external factors in the defense sector may temper near-term expectations.

Conclusion

As we approach the final trading days of the year, opportunities abound for savvy investors willing to dive into the technical and fundamental stories shaping the market. NVIDIA (NVDA) stands out with its bullish breakout and a favorable set-up in the semiconductor space, fueled by momentum in artificial intelligence and computing infrastructure. JetBlue (JBLU) is riding the seasonal wave of holiday travel demand, with an inverted head-and-shoulders pattern hinting at more upside potential if key resistance levels are breached. Meanwhile, Boeing (BA) is leveraging its strong technical breakout above the 50-week moving average, although challenges from emerging defense tech players loom in the background.

These stocks, each with unique catalysts, reflect broader market trends while offering traders the chance to capitalize on year-end movements. Whether you’re betting on the Santa Rally delivering late or preparing for a more competitive landscape in 2025, staying informed and adaptable is key. Keep an eye on these charts, the evolving fundamentals, and external developments like the $850 billion defense contract reshuffle to navigate the market with confidence. Here’s to ending the year on a high note and gearing up for an even more dynamic trading year ahead!

“Subscribe for Stock Picks, Trends & Trading Lessons sent directly to your inbox.”

Leave a comment