We’ll also, take a look at a few of equities and their price action: AVGO, NVDA, & FOUR.

“Subscribe for Stock Picks, Trends & Trading Lessons sent directly to your inbox.”

Table of Contents

- Morning Momentum

- SPX Trade Takes Me to Green

- Equity Highlights

- Trading Lessons from Today

- SPX & RTY Charts

- Final Thoughts

Morning Momentum

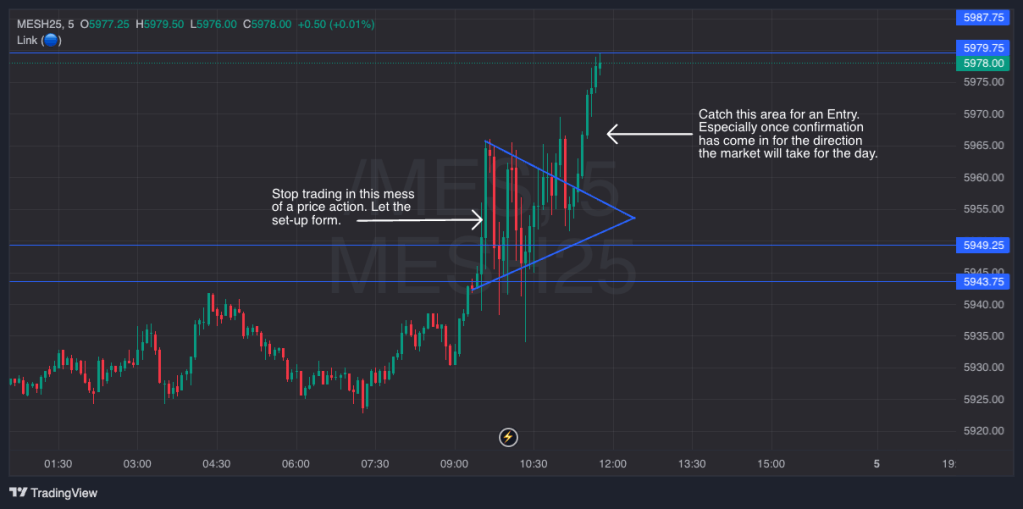

Today began with high hopes as I entered positions in MES and MNQ (Micro-SPX & Micro NASDAQ Futures COntracts). The market seemed to take off right out the gate, propelling my unrealized profits to more than $1,000 within a few minutes. However, greed and hesitation crept in, fueled by personal biases about what I “expected” the market to give me and the direction I “hoped” for.

This was my first lesson of the day: “The Market Owes You Nothing”. Mixing personal beliefs with an unpredictable market is a recipe for disappointment. My early gains quickly reversed into a -$200 realized loss.

SPX Trade Takes Me to Green

After stepping away from the NQ, which showed indecisive behavior due to the underperformance of tech-heavy stocks, I focused on SPX. Its support and resistance levels appeared more reliable. By the time of writing, I managed to recover and turn the day positive again.

The market today resembled a chaotic dance—up, down, sideways, and back again. Scalping proved effective, emphasizing the need for quick, decisive actions. “Steal the money when it’s in your pocket”.

Equity Highlights

Equities mirrored the futures market’s early volatility, bursting out of the gate at the open only to retrace gains within the first hour. However, there were a few exceptions:

NVDA

Showed a textbook Bull Flag formation and confirmed a breakout to the upside.

AVGO

Hovered within a pennant pattern but leaned bearish, requiring caution.

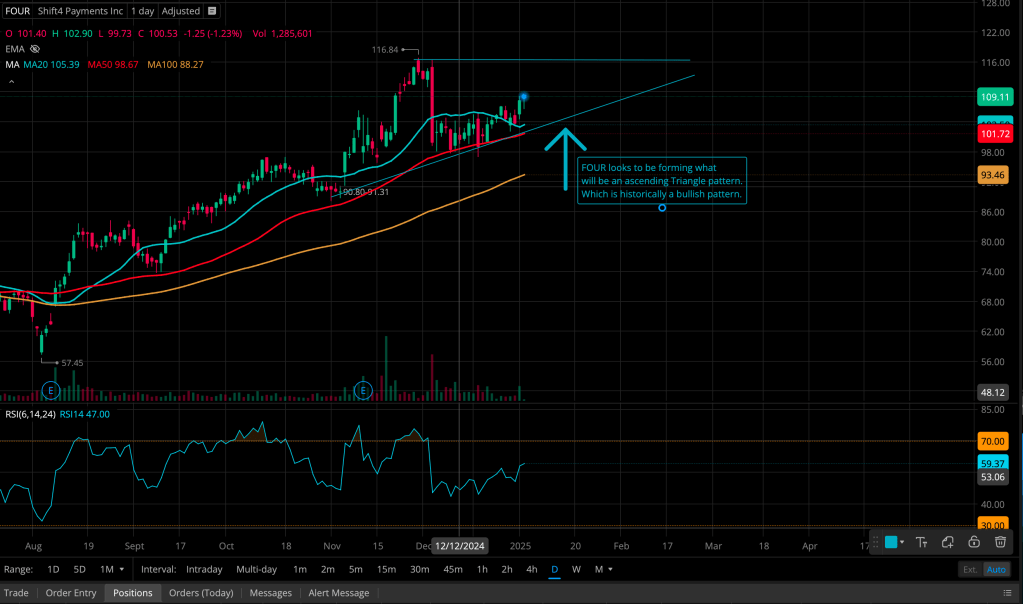

FOUR

A standout with bullish momentum, trading above its major moving averages, supported by positive earnings and strong analyst sentiment.

Trading Lessons from Today

Reflecting on today’s session, a few key lessons emerged:

- Patience is key: Great setups take time to form and even more time to confirm. Avoid rushing trades.

- Hope is not a strategy: Only trade when a valid setup is present, not based on what you “wish” the market would do.

- Avoid overtrading: Jumping in and out of trades while setups are forming leads to unnecessary losses and negative habits.

- Flow with the market: If you’re out of sync, pause, observe, and make small, calculated moves.

- Discipline over desire: Stick to your trading rules to minimize mistakes and maximize gains.

SPX & RTY Charts

SPX chart, and trading behavior.

RTY chart, and trading behavior.

Final Thoughts

Trading is a constant battle of psychology, discipline, and strategy. The markets are unpredictable, and every day brings new challenges. But each challenge offers a lesson. For me, today’s takeaway is simple: stay patient, stay disciplined, and trust the process.

What’s your biggest trading lesson this week? Share your thoughts in the comments below!

“Subscribe for Stock Picks, Trends & Trading Lessons sent directly to your inbox.”

Leave a comment