This week started with a glimmer of optimism before the broader market showed signs of weakness. Major indices such as the NASDAQ and SPY are down at the time of writing by more than 0.5%, the DOW started lower but bounced back halfway through trading day after news of Macquarie partnership on the gulf coast. Despite the broader pullback, opportunities are still emerging, especially in select sectors and a few patterns I’m tracking closely.

Here’s a breakdown of my trades, thoughts, and what I’m eyeing as we head into the holiday season and a potential Santa rally.

Aviation Takes Flight Amid Holiday Optimism

Last week, the market surged after the recent presidential election, with the biggest impact seen in crypto and crypto-related companies. However, the aviation and travel sector also gained significant momentum, buoyed by holiday travel and positive earnings revisions.

- Top Performers: AAL, DAL, and UAL all posted strong gains last week.

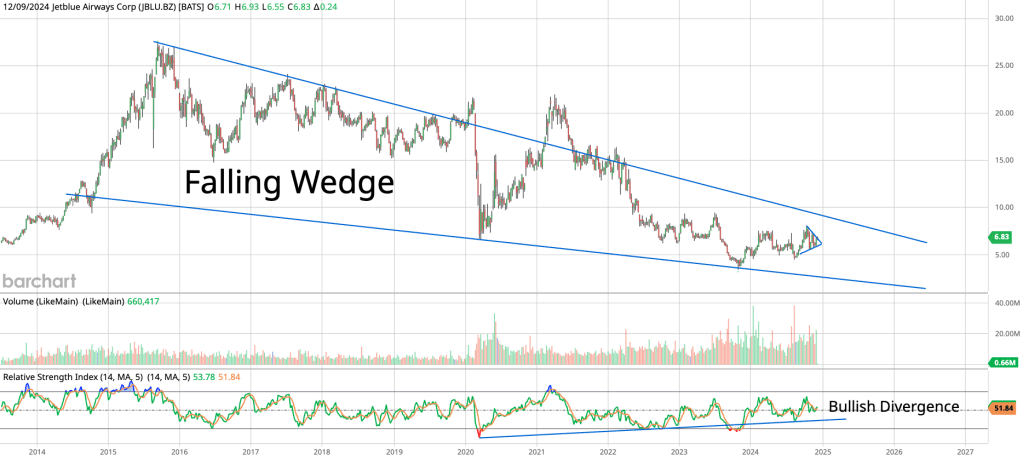

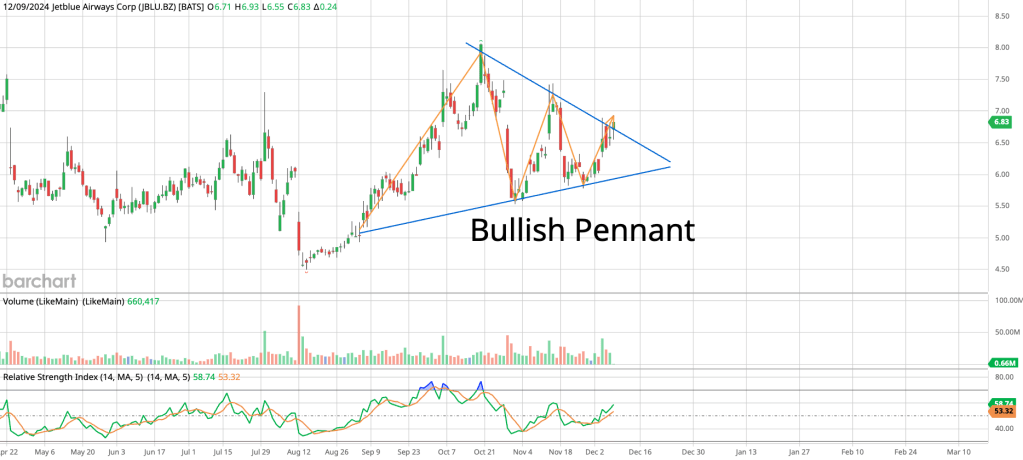

- Lagging but Promising: JBLU (JetBlue) has been in a multi-year falling wedge pattern. Within this larger pattern, the daily chart is showing a bullish pennant that just broke out around the $6.75 level.

My Trades:

I cautiously entered a position in JBLU after the breakout. Standing by before entering further until Wednesday’s CPI release.

JBLU – JetBlue

As we can see in the chart above, JBLU’s weekly chart is showcasing a falling wedge pattern. The RSI is also printing a bullish divergence. On the chart below we have JBLU’s daily chart forming a Bullish Pennant pattern.

As stated above my target for JetBlue is around $9.5-$10(+/-). This is the next major line of resistance. Any price above this target would confirm a breakout of the falling wedge. I believe we should see continued strength throughout the holiday season leading into the New Year.

GTLB – GitLab

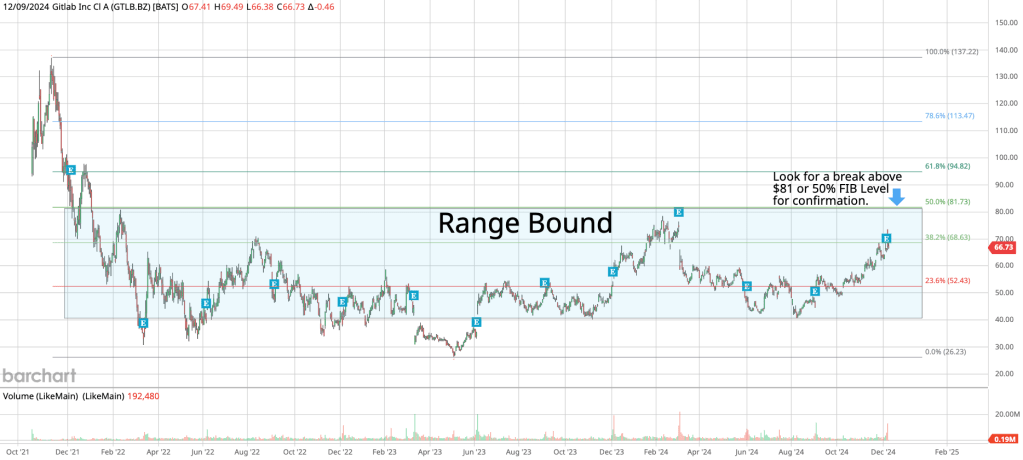

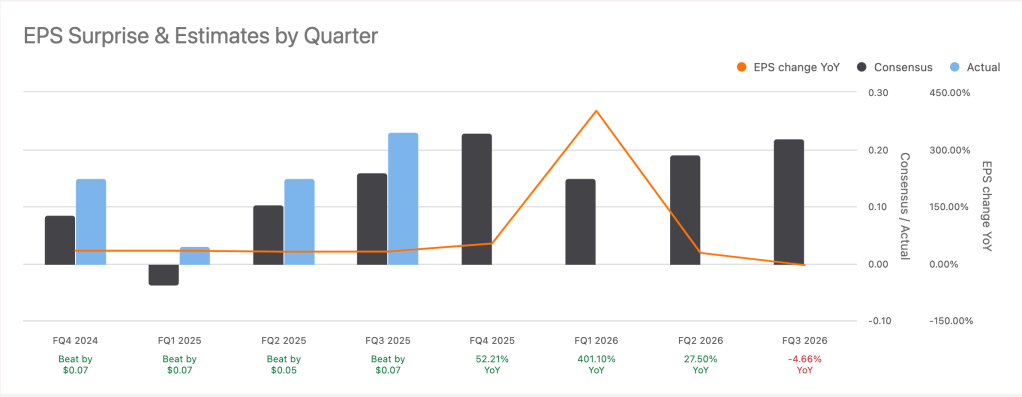

GTLB – GitLab has been performing well over the last 45 days after bouncing from a low of $40. This has been a repeating process of bouncing between a range of $30 to $60(+/-). Even though, the market hasn’t caught up with the companies positive results; GTLB continues to post positive earnings.

GTLB is a popular DevOps service, especially in the crypto universe. GTLB could catch the extra push it needs on the back of any continued success from the crypto Bull Run. Price is getting close to the top of the range will soon test the $76-$81 resistance area. A lot of analysts have their targets set at $80. But if we can break through this, then we could see it continue higher with little overhead resistance.

FRSH -FreshWorks

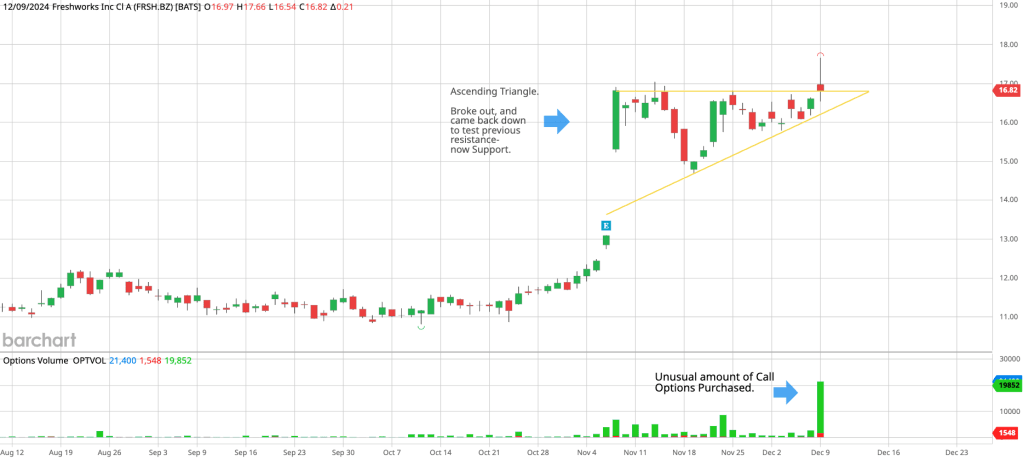

Next we have FRSH – FreshWorks. FRSH is a suite of SAAS products. Think Salesforce but on a much smaller scale. As of late they have been picking up momentum. They too, like GTLB have been posting Beat after Beats on their earnings calls. Price has been consolidating and forming an Ascending Triangle pattern since November 4th.

This morning the markets opened up with a lot of momentum but just as fast as they shot up, they quickly came tumbling down. FRSH’s price broke out with a lot of enthusiasm but came back down and is now retesting previous resistance, now support at $17.

You’ll also notice the major spike in unusual option volume, more 19k in Calls were bought this morning. This is telling me that maybe someone knows something the rest of us don’t, they were purchased for a 1/17/2025 expiration date. If we can get some strong follow through I’ll be looking for a price target of $24.

YETI: A Hidden Gem for 2025?

YETI Holdings (YETI) stands out as a stock with significant upside potential over the next few months. Recent earnings highlighted strategic moves to exit China, reducing tariff risks. They’re also expanding into new outdoor and lifestyle categories, diversifying beyond their roots in drinkware and coolers.

Current Setup:

- Trading range: $33–$50.

- Positive earnings momentum and strong brand recognition could fuel a breakout in Q1 2025.

Profit-Taking: Selling into Strength

This morning, I took profits on several positions, including WMT, NTAP, RIVN, TGT, and AAPL, all of which had calls expiring on Dec. 20th. These trades returned gains between 150-300%, which aligns with my trading style of selling into strength.

While I believe some of these names may still have upside, locking in profits ensures I maintain discipline and manage risk.

Current Portfolio Positions

Here’s a snapshot of the positions I’m currently holding:

AAPL, HOOD, DIS, JBLU, ACHR, JOBY, YETI, ZM, GSAT, and ROKU.

I’m actively monitoring these trades for opportunities to scale in or adjust as the market unfolds.

Looking Ahead: CPI, PPI, and the Santa Rally

The coming week will be pivotal, with the CPI (Wednesday) and PPI (Thursday) releases likely driving market sentiment. My overall outlook remains bullish for the remainder of the year, and I anticipate the possibility of a strong Santa rally.

Sectors I’ll be watching closely:

- Travel and Leisure: Continued seasonal strength.

- Tech and SaaS: Momentum plays like GTLB and FRSH.

- Consumer Discretionary: Stocks like YETI poised for recovery.

Stay tuned for daily updates as I navigate these trades and share lessons along the way.

Final Thoughts: Documenting the Trading Journey

I’m excited to continue documenting my trading journey here on TradeProfitJournal.com. This blog is not just about the wins but also about the lessons learned along the way. Whether you’re a seasoned trader or just starting, I hope my insights and experiences help you find your own edge.

Leave a comment